Wealth management firms for the ultra-rich quietly increased their exposure to U.S. equities in the first quarter of the year, just before President Donald Trump’s surprise tariff announcement triggered a sharp, temporary sell-off in global markets.

Regulatory filings show that several prominent family offices—including those tied to European dynasties and billionaire investors like Noam Gottesman and Alan Parker—added to their U.S. stock positions in the quarter ending March 31, days before Trump’s so-called “Liberation Day” on April 2, which sparked market turmoil.

Alta Advisers, which manages assets for the Rausing family of Sweden, expanded its holdings across more than 100 U.S.-listed companies, including tech heavyweights like Nvidia, Apple, and Amazon. Similarly, Gottesman’s Toms Capital added Nvidia and several other stocks, while the Parker family’s Kemnay Advisory Services took larger positions in over a dozen U.S. equities.

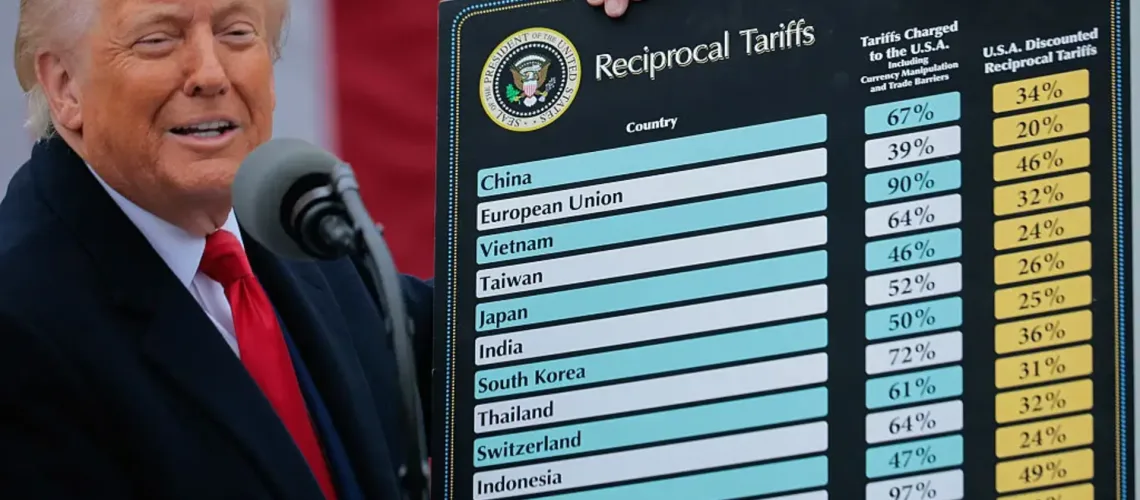

These moves were made just ahead of Trump’s steep tariff announcement, which erased an estimated US$6 trillion in market value over two days. Since then, the S&P 500 has rebounded by around 19% from its April 8 low.

Other wealthy investors, such as Carlos Slim and Sweden’s Persson family, took advantage of the market chaos to increase their stakes in existing holdings—positions that have since appreciated significantly.

The data comes from quarterly 13F filings, which provide rare insight into how major investors—including hedge funds and large family offices—are allocating capital in U.S. markets.

Additional 13F highlights:

- Stan Druckenmiller’s Duquesne family office bought into U.S. software firms, including new stakes in Docusign (US$87 million) and CCC Intelligent Solutions (US$51 million).

- David Tepper’s Appaloosa LP exited its positions in AMD (US$145 million) and FedEx (US$98 million), while opening a US$89 million stake in Deutsche Bank.

- David Bonderman’s Wildcat Capital Management made a US$16.7 million investment in Acuren, a provider of engineering and inspection services.