Nearly 80 percent of family offices rely on spreadsheets as their core reporting tool, yet many still face regulatory hurdles and data challenges. With growing demands for tax transparency and stricter compliance, establishing a solid financial reporting process is more important than ever. This step-by-step guide walks you through the essentials, from defining objectives to securing data, so you can build a reliable reporting framework that meets global standards.

Table of Contents

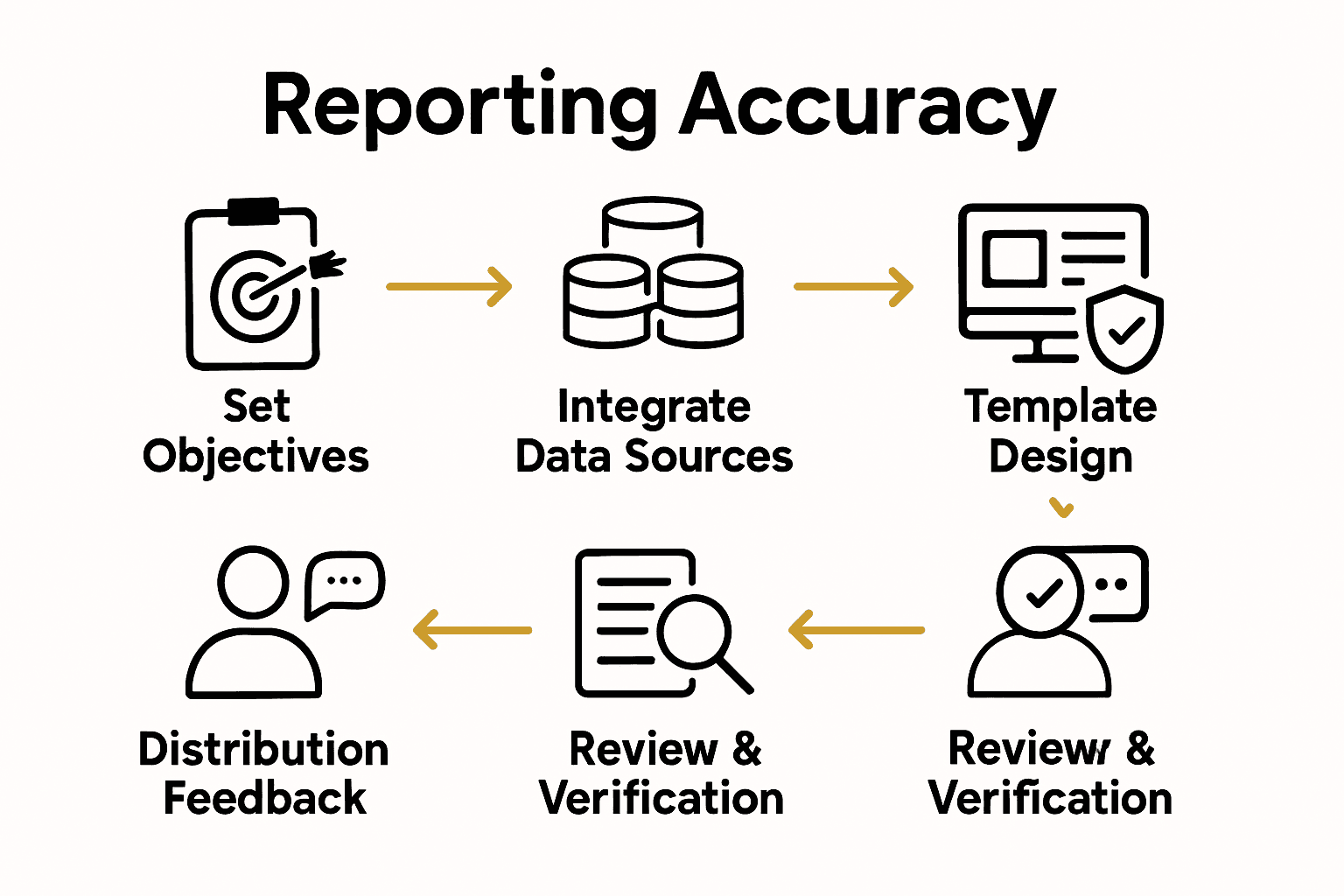

- Step 1: Define Reporting Objectives And Compliance Needs

- Step 2: Select Appropriate Data Sources And Tools

- Step 3: Design Reporting Templates And Schedules

- Step 4: Implement Secure Data Collection And Validation

- Step 5: Review And Verify Reports For Accuracy

- Step 6: Distribute Reports To Stakeholders And Gather Feedback

Quick Summary

| Key Point | Explanation |

|---|---|

| 1. Define reporting objectives clearly | Outline compliance needs and performance tracking goals specific to your family office’s operations. |

| 2. Select reliable data sources and tools | Choose verified financial data sources and robust financial management software to ensure accuracy and efficiency. |

| 3. Create standardized reporting templates | Develop master templates for consistent financial summaries, tailored to diverse stakeholder needs. |

| 4. Implement secure data collection processes | Establish data governance protocols to protect sensitive financial information and ensure accuracy. |

| 5. Gather feedback on reports | Encourage stakeholder feedback and continuously improve reporting clarity and utility for better decision-making. |

Step 1: Define reporting objectives and compliance needs

In this critical first step, you will map out the essential reporting framework for your family office that ensures regulatory compliance and establishes clear performance tracking guidelines. Understanding your specific reporting objectives is foundational to maintaining transparent and accurate financial management.

According to PwC, family offices must establish clear reporting objectives to meet international tax transparency standards like CRS and FATCA. This means you need to carefully outline your specific compliance requirements and create a systematic approach to financial reporting. Start by identifying the key regulatory frameworks relevant to your family office operations such as local tax laws, international reporting standards, and any jurisdiction specific requirements.

To build a robust reporting structure, Smart Vibe Invest recommends implementing a well structured governance framework that defines precise roles, responsibilities, and reporting guidelines. Your framework should include:

- Clear designation of who prepares financial reports

- Specific timelines for report generation

- Standardized report formats

- Compliance checklist for each reporting cycle

Warning: Incomplete or inconsistent reporting can trigger costly audit inquiries and potential financial penalties. Take time to develop a meticulous and comprehensive reporting strategy that leaves no room for ambiguity.

Once you have defined your reporting objectives, you will be ready to select appropriate reporting tools and technologies that can support your specific compliance and tracking needs.

Step 2: Select appropriate data sources and tools

In this step, you will strategically identify and select the most reliable data sources and technological tools that will form the backbone of your family office reporting infrastructure. Your goal is to create a comprehensive and integrated system that captures financial information accurately and efficiently.

When selecting data sources, consider multiple streams of financial information that provide a holistic view of your investments and assets. These might include bank statements, investment platform reports, real estate portfolio documentation, private equity performance records, and tax filing information. Aim to gather data from primary sources that offer direct and verified financial information.

Your technological toolkit should include robust financial management software that can aggregate data from multiple sources seamlessly.

Look for platforms that offer:

Look for platforms that offer:

- Multi currency support

- Advanced data integration capabilities

- Customizable reporting templates

- Strong security protocols

- Real time data synchronization

- Compliance tracking features

Warning: Not all financial software is created equal. Invest time in rigorous product demonstrations and trial periods to ensure the tools genuinely meet your specific family office reporting requirements. A misaligned technology solution can create more reporting challenges than it solves.

Once you have selected your data sources and tools, you will be prepared to establish systematic data collection and validation processes that ensure the integrity and accuracy of your financial reporting.

Step 3: Design reporting templates and schedules

In this crucial step, you will create standardized reporting templates and develop a strategic schedule that ensures consistent financial tracking and timely communication across your family office. Your goal is to establish a reliable and predictable reporting framework that provides clear insights into your financial landscape.

According to Fund Count, many family offices continue to rely on Excel for core financial work. This means you can leverage familiar spreadsheet tools to design your reporting templates. Start by creating a master template that captures key financial metrics such as asset allocation, investment performance, cash flow, and portfolio valuation. Ensure your template includes sections for:

- Summary dashboard

- Detailed investment breakdowns

- Performance comparisons

- Risk assessment metrics

- Liquidity analysis

As Asseta suggests, your reporting templates should be highly customizable with options for filters, custom groupings, and calculated fields. This flexibility allows you to adapt reports for different stakeholders and provide tailored financial insights that meet specific informational needs.

Warning: Consistency is key. Develop a standardized reporting schedule with predetermined frequencies for different types of reports monthly, quarterly, and annual financial summaries. Automate where possible to reduce manual data entry and minimize human error.

Once your templates and schedules are established, you will be prepared to implement a systematic approach to financial reporting that provides transparent and actionable financial intelligence.

Step 4: Implement secure data collection and validation

In this critical step, you will establish a robust framework for collecting and validating financial data that ensures maximum security, confidentiality, and accuracy across your family office reporting processes. Your primary objective is to create a systematic approach that protects sensitive financial information while maintaining data integrity.

According to Wikipedia, statistical disclosure control techniques are essential for ensuring that data collection and reporting do not accidentally reveal confidential information about respondents. This means implementing multiple layers of data protection strategies. Start by creating a comprehensive data governance protocol that includes:

- Encryption for all financial documents

- Access controls with multi factor authentication

- Role based permissions for data viewing and editing

- Secure cloud storage with advanced protection mechanisms

- Regular security audits and vulnerability assessments

Additionally, Wikipedia highlights the importance of bringing diverse data sources into a centralized interface for continuous monitoring. In practice, this translates to developing a unified data validation system that cross references information from multiple sources to verify accuracy and detect potential discrepancies.

Warning: Never compromise on data security. Implement end to end encryption, use secure transmission protocols, and regularly update your security infrastructure to protect against emerging cyber threats. A single security breach could compromise your entire financial reporting ecosystem.

Once you have established your secure data collection and validation processes, you will be prepared to move forward with generating comprehensive and trustworthy financial reports.

Step 5: Review and verify reports for accuracy

In this pivotal step, you will develop a meticulous approach to reviewing and verifying financial reports that ensures absolute accuracy and compliance across your family office reporting ecosystem. Your objective is to implement a comprehensive verification process that catches potential errors and validates financial information before final submission.

According to Smart Vibe Invest, regular audits and third party reviews are vital for ensuring the accuracy of family office reports. This means establishing a multi layered verification strategy that goes beyond internal checks. Create a systematic review process that includes:

- Cross referencing data from multiple financial sources

- Conducting line by line financial statement reconciliation

- Performing trend analysis and variance checks

- Validating calculations and computational accuracy

- Reviewing supporting documentation for each financial entry

As PwC emphasizes, navigating compliance requirements like CRS and FATCA demands vigilance to avoid potential inaccuracies. Accurate reporting at the entity level is critical to mitigate the risk of audit inquiries or potential financial penalties.

Warning: Never assume reports are correct on the first pass. Develop a disciplined review process that involves multiple team members and potentially external auditors to provide an additional layer of scrutiny and validation.

Once you have thoroughly reviewed and verified your reports, you will be prepared to confidently distribute financial information to stakeholders with the highest level of precision and reliability.

Step 6: Distribute reports to stakeholders and gather feedback

In this final step, you will develop a strategic approach to sharing financial reports with key stakeholders and creating a systematic feedback mechanism that continually improves your reporting process. Your goal is to transform report distribution from a simple information transfer into an interactive and collaborative communication experience.

Begin by segmenting your stakeholders into distinct groups with tailored reporting needs. This might include family members, investment managers, financial advisors, tax professionals, and regulatory compliance officers. Create customized report versions that provide appropriate levels of detail and insight for each group. Consider implementing:

- Secure digital distribution platforms

- Personalized access portals

- Interactive dashboard views

- Comprehensive executive summaries

- Detailed technical breakdowns for specialist stakeholders

Design a structured feedback collection process that encourages honest and constructive input. Develop standardized feedback templates with specific questions about report clarity, comprehensiveness, and usefulness. Consider offering multiple feedback channels such as digital surveys, direct email communication, and scheduled review meetings to accommodate different stakeholder preferences.

Warning: Confidentiality remains paramount. Ensure all distribution channels have robust security protocols and that stakeholders sign appropriate non disclosure agreements before accessing sensitive financial information.

By establishing an open and responsive reporting ecosystem, you create a dynamic environment of continuous improvement and transparent financial communication.

Elevate Your Family Office Reporting with Trusted Industry Connections

Accurate and secure financial reporting is vital for every family office striving to maintain transparency and avoid costly errors. The challenge lies in mastering complex compliance requirements while managing diverse data sources and ensuring secure validation. If you want to overcome these hurdles with confidence, you need access to expert insights, proven tools, and a trusted network that supports your goals.

Discover a comprehensive resource tailored for family office professionals at Future Family Office. Our platform connects you to service providers specializing in reporting technologies, governance frameworks, and compliance solutions. Benefit from expert articles and industry updates that help you design standardized reporting templates and implement secure data collection strategies. Start enhancing your reporting accuracy and stakeholder collaboration today by visiting our directory of family offices and service providers. Take control of your financial reporting process now by joining the global community of family office leaders at Future Family Office.

Frequently Asked Questions

What are the essential reporting objectives for a family office?

Establishing essential reporting objectives involves identifying regulatory compliance needs and outlining performance tracking guidelines. Start by mapping your specific compliance requirements, such as local tax laws, to ensure your family office meets international standards like CRS and FATCA.

How can I select appropriate data sources for family office reporting?

To select reliable data sources, gather financial information from multiple primary streams like bank statements and investment platform reports. Review these sources to ensure they provide verified financial data that can create a comprehensive view of your assets and investments.

What are the key components of a standardized reporting template?

A standardized reporting template should include sections for key financial metrics like asset allocation, performance comparisons, and cash flow analysis. Create a master template incorporating these elements to provide clear insights and facilitate easy adjustments for specific stakeholder needs.

How can I ensure secure data collection and validation for financial reports?

Implement a robust framework for secure data collection by utilizing encryption, access controls, and secure cloud storage. Regularly audit your security protocols to maintain confidentiality and protect sensitive financial information from potential breaches.

What steps should I take to review and verify financial reports?

Establish a multi-layered verification process that includes cross-referencing data and conducting line-by-line reconciliations. Gather multiple team members to assist in the review, ensuring accuracy and compliance before final report distribution.

How do I effectively distribute financial reports to stakeholders and gather feedback?

Segment your stakeholders and customize report versions that cater to their specific needs. Utilize secure digital distribution platforms to share reports, and implement feedback channels to encourage constructive input on report clarity and usefulness.

Recommended

- January 2020 Family Office Data Report – Future Family Office

- What Do Banks Believe Family Offices Should Focus On? – Future Family Office

- How can we Prepare the Now Generation of Family Business? – Future Family Office

- How can we Prepare the Now Generation of Family Business? – Future Family Office

- 7 Tax Filing Best Practices for IRS Issue Resolution Success – Unique Solutions to IRS Tax Problems