Billionaire Dan Gilbert isn’t just preserving his fortune—he’s transforming his hometown. Through his family office, Rock Ventures, Gilbert is channeling his $27.8 billion net worth into a broad revitalization strategy for Detroit and Cleveland. This positions him among a growing wave of ultra-wealthy individuals using their family offices for impact far beyond personal wealth management.

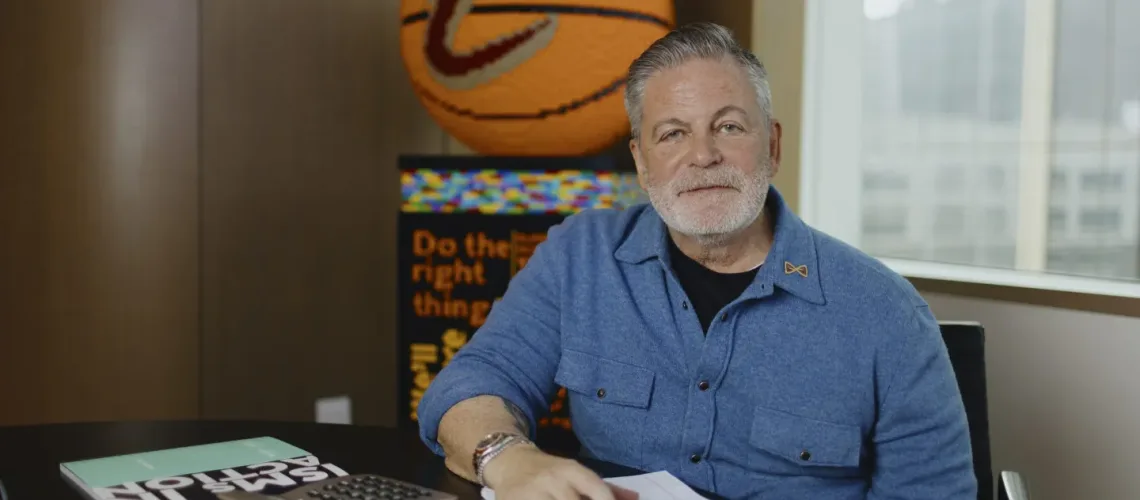

Gilbert, the founder of Rocket Mortgage and owner of the Cleveland Cavaliers, has spent years investing in Detroit’s urban revival. His efforts go beyond traditional business interests, driven by a deeply personal mission to restore pride in a city he felt was long misunderstood. “If I ever had the chance to change that perception, I would,” he says.

From his headquarters at One Campus Martius—home to Rocket, StockX, and others—Gilbert’s influence radiates. Tucked just below the main floors is Rock, his 70-person family office, which coordinates everything from venture investments to civic revitalization projects. While most family offices operate behind closed doors, Gilbert’s is intentionally public-facing, reflecting his ethos of “for more than profit.”

Rock’s investment strategy goes beyond financial returns. It backs startups like e-bike brand Bloom and furniture company Floyd, and helped orchestrate Rocket’s $1.75 billion acquisition of Redfin. But the goal is broader: attracting talent, building community, and creating a self-reinforcing cycle of urban growth. Gilbert’s approach blends real estate, tech, and civic development—all under one roof.

Gilbert’s use of his family office as an urban transformation engine is part of a global trend. According to Deloitte, there are now over 8,000 family offices managing more than $3 trillion globally—a number projected to grow 75% by 2030. As this sector scales, so does its influence. In 2022, family offices accounted for nearly a third of startup funding globally, according to PwC.

Legacy is a core part of the family office model. Gilbert’s eldest son Grant already plays an active role, running his own ventures out of the OCM building. Their family focus goes beyond inheritance—it’s about shared values and long-term purpose. As Gilbert puts it, “We built this wealth over 40 years. Now it’s time to deploy it—while I’m still here to see the results.”

Not all responses have been positive. Critics point to Gilbert’s tax incentives and the geographic concentration of his developments. Some argue no individual should wield such influence over a city’s fate. But for many Detroiters, Gilbert’s investments have made him a civic symbol. His developments have brought life back to the city’s core—and helped make events like the 2024 NFL Draft possible, drawing 750,000 visitors and putting Detroit back on the map.

His ultimate goal? A thriving, bustling downtown that mirrors the city’s mid-century peak. Gilbert isn’t trying to run Detroit—but he does want to shape its future. And through Rock, he just might.