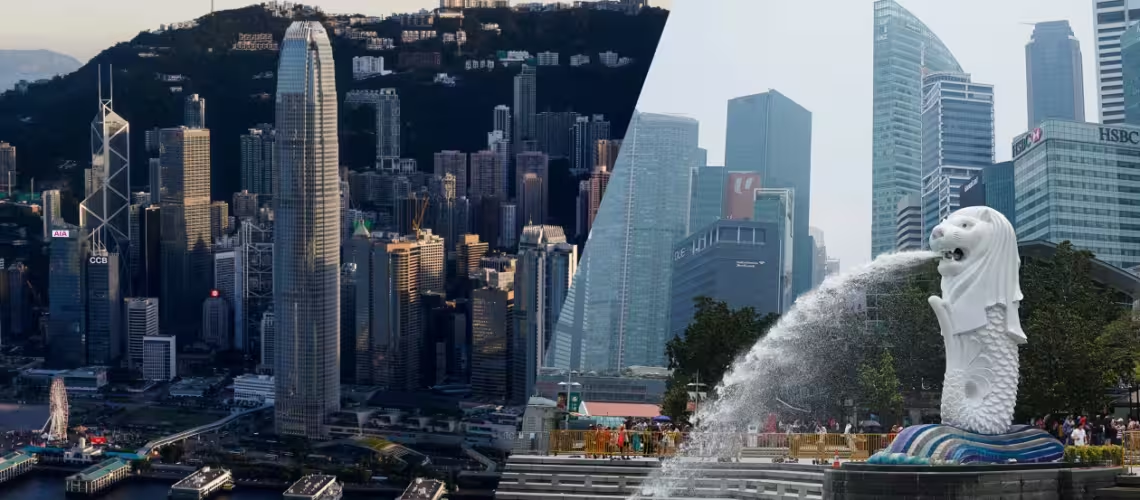

Some of China’s wealthy families are turning to Hong Kong to manage their assets as Singapore’s intense scrutiny slows their plans to establish family offices. Following a significant money laundering bust, Singapore's approval process has become more stringent, leading some Chinese clients to consider Hong Kong as a fallback.

Professionals in the single-family office sector, which manages the assets of wealthy individuals, told Nikkei Asia that some Chinese clients are now parking their wealth in Hong Kong. The Monetary Authority of Singapore (MAS) has reportedly rejected applications from Chinese passport holders, pushing them towards Hong Kong.

Hong Kong and Singapore have been competing to attract wealthy Chinese investors. While some have avoided Hong Kong due to mainland China’s control, Singapore’s increased scrutiny following recent money laundering cases has driven others back to the city.

A source assisting wealthy Chinese with private offices said three clients have opted to set up family offices in Hong Kong after facing delays in Singapore. "Many just want to move quickly, and in Hong Kong, you can set up [family offices] within a couple of weeks," the person said, noting that establishing a family office in Singapore can take over a year due to MAS’s stringent application process and backlog.

Another industry insider mentioned that two of their Chinese clients have considered Hong Kong due to operational difficulties in Singapore. Two wealth management executives also reported inquiries from Chinese clients who were denied tax incentives in Singapore.

A lawyer noted that Hong Kong does not ask if applicants were rejected elsewhere, but wealth managers must follow anti-money laundering practices. Hong Kong’s Inland Revenue Department checks previous structures used by family office applicants to ensure tax compliance.

Hong Kong offers other residency paths for wealthy individuals, such as the Capital Investment Entrant Scheme, which requires applicants to have no criminal convictions.

As of the end of 2023, Hong Kong had approximately 2,700 single-family offices, according to a Deloitte report. Novia Lu, director of business development for Ocorian in Asia-Pacific, observed a shift in attitudes among her Chinese clients, with many seeking culturally similar destinations to diversify their assets.

Singapore’s scrutiny increased after police arrested 10 individuals last August in the country’s largest money laundering case, seizing or freezing assets worth over 3 billion Singapore dollars. Some of those involved were linked to family offices given tax incentives, leading to tougher permanent residency requirements for wealthy Chinese.

However, industry players suggest that the pivot from Singapore to Hong Kong may be temporary. Concerns about Hong Kong’s closer ties to Beijing and potential oversight from mainland authorities persist. Despite challenges, the U.S. and Canada remain popular destinations for wealthy Chinese individuals.

Anti-money laundering issues affect all global offshore wealth centers, including Singapore and Hong Kong, noted Cai Hua, COO of Fosun Wealth. In Singapore, 1,400 single-family offices qualified for tax incentives by the end of last year, a 27% increase from 2022. Hong Kong had 2,700 single-family offices by the end of 2023.

Singapore aims to attract capital while eliminating bad actors. MAS plans to review and tighten its incentive administration processes for family offices, setting deadlines for tax incentive applicants to respond to queries.

MAS acknowledged that application momentum remains strong but has decreased from the highs of the COVID-19 years. The authority aims to clear the backlog and reduce waiting times for new applicants this year.

This post originally appeared here.