Industrial companies have given a flurry of updates over the past few weeks at Wall Street conferences and the general refrain has been that the business trends that led to a steep slump in sales in April more or less continued in May. Second-quarter volumes are trending down about 23% for railroad Union Pacific Corp., roughly in line with its April forecast for a 25% slide, chief financial officer Jennifer Hamann said at the UBS Group AG conference this week. “We are maybe feeling just a tad more optimistic,” Hamann said. “It’s hard to feel real optimistic when you still are facing volumes down 23%, but it does feel like things have maybe bottomed a little bit. It’s hard to call the bottom, though, because I think there’s still a fair amount of uncertainty in terms of how the reopening is going: Will there be another resurgence of outbreak with the coronavirus? And how do people engage in the economy again? And what’s the trajectory relative to unemployment? So a lot of question marks out there that still need to be answered.”

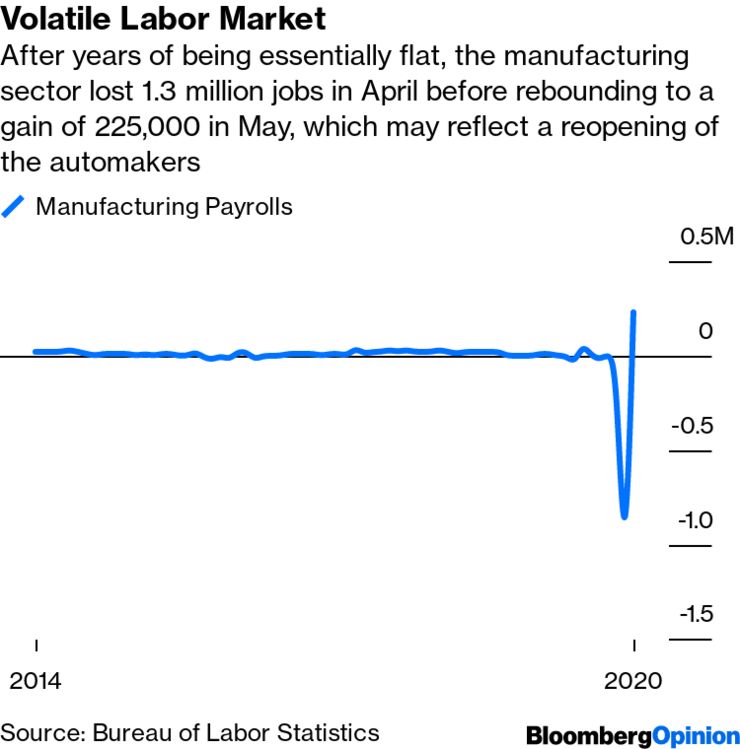

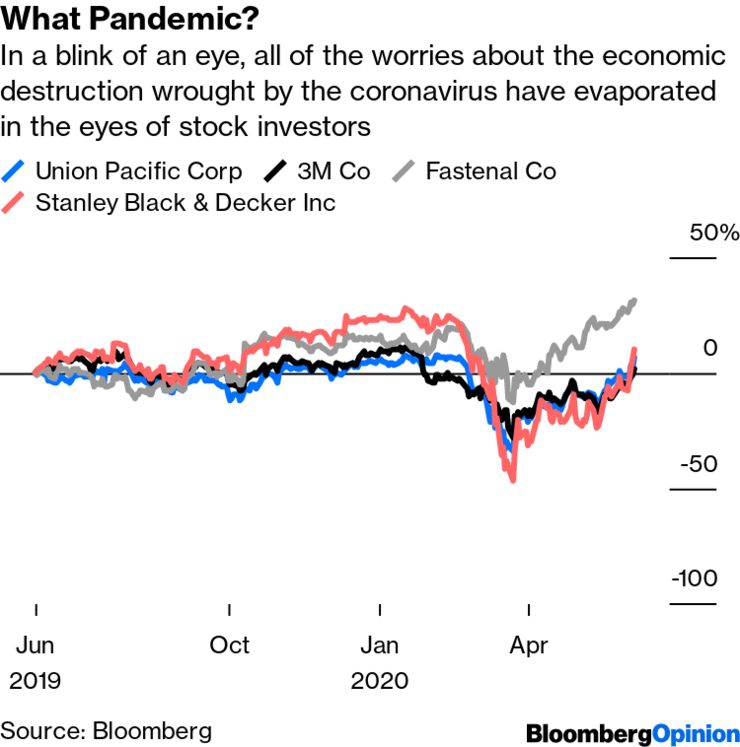

She’s right, of course, but the equity markets have already deemed those questions effectively answered. The better-than-expected jobs report on Friday offered a basis for cautious optimism that the economy is recovering faster than expected, providing a boon for more cyclical sectors like industrials. But it’s notable that the upside surprise came on the same day that Bombardier Inc. announced it would cut its aviation workforce by 2,500 people and Bentley Motors Ltd. said it would eliminate as many as 1,000 jobs in the U.K., adding to a slew of layoffs across the transportation and aviation sectors. Union Pacific, for its part, has acknowledged that the pandemic may provide an opportunity to accelerate cost-cutting efforts as part of its transition to precision-scheduled railroading and add to the 6,200 positions it eliminated on a year-over-year basis in the first quarter. Shares of Union Pacific are now up for the year, putting the company within spitting distance of the all-time high set in January.

Meanwhile, 3M Co.’s soon-to-be-former CFO Nick Gangestad, speaking at the same conference, said the winners and losers of the company’s businesses were the same in May as they were in April. The company continued to see weakness in consumer electronics, oral care, automotive, industrial and commercial products as well as stationary and office supplies in May, offset in part by demand for personal-safety gear, data-center and semiconductor equipment, general cleaning supplies and goods that relate to food safety and biopharma filtration. He indicated that the overall May sales figure was comparable to the 12% decline in organic revenue that 3M reported in April after accounting for fewer billing days in the period; the company will provide more formal data later this month. 3M shares are higher than this time last year, with a tumultuous intervening stretch of repeatedly lowered guidance, a U.S.-China trade war and a pandemic.

Over at Raytheon Technologies Corp., for the commercial aerospace businesses, “the trends that we saw in April, they continue into May,” CFO Toby O’Brien said at the UBS conference. Free cash flow for the quarter across the company will be an outflow of $1.5 billion, even with fundamental contributions from the defense businesses holding steady, he said. Shop visits for Pratt & Whitney jet engines are trending down 60% to 70% in the second quarter and aftermarket maintenance work for the Collins aerospace parts business is down in the ballpark of 50% to 60%. Raytheon has previously said it expects both metrics to be down 50% for the remainder of the year. The stock is up more than 60% since the overall market bottomed in late March.

I don’t need to be the umpteenth person to tell you the market is acting weird and at risk of getting too far ahead of itself. I sincerely hope for everyone’s sake that equity investors are right and the corporate executives are being too cautious. But the perspective of management still matters. And there are some pretty wild dislocations out there right now, particularly when it comes to those few companies that are weathering the pandemic comparatively well for idiosyncratic reasons.

Take industrial distributor Fastenal Co., whose sales of personal-protective gear helped buoy daily revenue in May to a gain of 14.8%. Revenue from products more closely related to manufacturing saw narrowing declines in the month. The stock took a slight breather on the news this week but it’s still up about 50% since the market bottom, and as my colleague Robert Burgess pointed out, the gains have outpaced those of the NYSE Fang+ Index. Fastenal’s current price-earning ratio is at a five-year high, which is pretty staggering for a company whose earnings were never really that depressed by the pandemic and thus don’t have much room to “recover.”

Then there’s Stanley Black & Decker Inc. The company was down about 10% for the year as of midday on Friday, worse than the benchmark Industrial Select Sector SPDR Fund, but it feels expensive at a forward price-earnings ratio of about 28. That may be a case of analysts’ estimates lagging behind the reality that Stanley is one of the few manufacturers to already be reporting tangible improvements in its business, says Wolfe Research analyst Nigel Coe. When Stanley reported earnings in April, it anticipated sales being down as much as 45% in the second quarter, excluding the impact of currency swings and M&A. In mid-May, revenue momentum gave it the confidence to improve its forecast to a slump of only as much as 30%. Now, it sees sales down at worst 20% in the period ending June 30. The company chalks up its brightened outlook to strong demand for its tools as people attempt more do-it-yourself projects on the homes they’ve spent so much time in lately, as well as for security solutions as businesses implement safety measures such as touchless doors and temperature screening.

Last but not least is American Airlines Group Inc., which saw the biggest one-day gain in its post-bankruptcy history on Thursday on the prospect that capacity would be down “only” 60% in July. The domestic thrust of American’s upbeat announcement suggests continued weakness in the international markets key to the airline’s financials, implying revenue forecasts may in fact need to move down, not up, JPMorgan Chase & Co. analyst Jamie Baker wrote in a report. There appears to be “investor confusion,” he wrote, in what is possibly the most perfect, succinct understatement to describe 2020.

PROTESTS

In the wake of the tragic, inexcusable death of George Floyd, companies from all walks of life have decided this is one controversy where silence isn’t an option. All but a handful of the 50 largest companies in the U.S. have responded publicly to the events, according to an analysis by Bloomberg News. Even manufacturers such as Boeing Co. that have little direct interaction with consumers have made statements. This letter from Eaton Corp. CEO Craig Arnold stands out and you should make time to read it. 3M CEO Michael Roman made a point of kicking off his appearance at the UBS conference this week by commenting on the events, which took place in the company’s backyard of Minnesota. “I’m heartbroken and appalled at the senseless death of George Floyd,” Roman said. “As I talk with other CEOs, we are resolved to turn this into a call to action that finally makes a difference. All of our institutions must respond and take up the mantle of leading change here, and this includes our companies and their leaders. Businesses have a unique opportunity to help lead our community forward.” There’s plenty of criticism of these kinds of statements as mere virtue signaling, but that misses the fact that corporate America has grown increasingly vocal on issues of right and wrong. Companies should be held to their words. But whether it’s investors’ increased support for ESG initiatives, a need to fill a leadership void amid endless political squabbles or the background of the pandemic that’s driving this change, I’m optimistic that we’re witnessing a kind of rebirth of corporate America as a pillar of the community and it’s in everyone’s best interest to encourage that evolution.

DEALS, ACTIVISTS AND CORPORATE GOVERNANCE

3M Co. unexpectedly announced this week that CFO Nick Gangestad would retire and be replaced by General Electric Co. executive Monish Patolawala on July 1. The decision to shake up the management team in the middle of a pandemic that’s caused a spike in demand for 3M’s safety-gear products but a slump in sales for everything else is a bit odd, especially as Gangestad has only been in the job for six years. But Gangestad was a holdover from Inge Thulin’s reign as 3M’s CEO, and it’s not uncommon for new CEOs to eventually want a CFO of their own choosing. Michael Roman, who became CEO in 2018, has had a rough two years and things aren’t going to get any easier from here. Patolawala’s to-do list ranges from the coronavirus fallout to restoring the company’s credibility on guidance to managing legal issues linked to per- and polyfluoroalkyl substances, the so-called “forever chemicals.” It’s worth noting that Patolawala has been at GE for about 25 years, making him more a product of the Jeff Immelt-era than the Larry Culp one, but he seems to have benefited from the latter’s halo effect. Patolawala is currently CFO of GE’s health-care division and “has also been working closely” with Culp as vice president of operational transformation, 3M said in the press release. It’s not often you see companies cite experience working with another CEO to bolster the credentials of a new hire.

Rollins Inc., a pest-control company that operates under the Orkin brand among others, is exploring a possible sale, Bloomberg News’s Ed Hammond reported this week. The company hasn’t yet launched a formal auction and may decide to remain independent. The coronavirus pandemic has left Rollins comparatively unscathed; pest control is one of those services you just can’t hit the pause button on, even if there are no people in office buildings. Incredibly, the company’s stock hit a new high the day before the report of a possible sale. That may explain why the Rollins family — which owns roughly 55% of the company, by Jefferies analyst Mario Cortellacci’s estimate — is willing to consider a sale now. Some intra-family drama may also be playing a role. But the company’s high valuation (it trades for more than 30 times its expected Ebitda in 2021) and roughly $15 billion market value may be a hurdle to many would-be buyers. Rival pest-control company Anticimex — backed by private equity firm EQT — is one of the suitors that makes the most sense for Jefferies’ Cortellacci.

W.W. Grainger Inc. announced it’s selling its Fabory Western European operations to private equity firm Torqx Capital Partners for an undisclosed amount. The deal is the latest in the industrial distributor’s efforts to unwind an international expansion that didn’t pan out as hoped. Grainger purchased Fabory in 2011 for $344 million. But the business lacked the scale to compete in a consolidated European market and an attempt to bolster it through the 2015 acquisition of U.K.-based industrial distributor Cromwell was poorly timed, closing less than a year before the Brexit vote, notes Melius Research’s Jake Levinson. Grainger took a $139 million writedown on the Cromwell business in 2018 and a $177 million charge on the Fabory operations in the first quarter. For now, Grainger will continue to serve Western European customers through Cromwell and its Zoro online offering, but it’s possible the Cromwell business could also wind up being divested at some point.

About the author: Brooke Sutherland is a Bloomberg Opinion columnist covering deals and industrial companies. She previously wrote an M&A column for Bloomberg News.

Read original article here