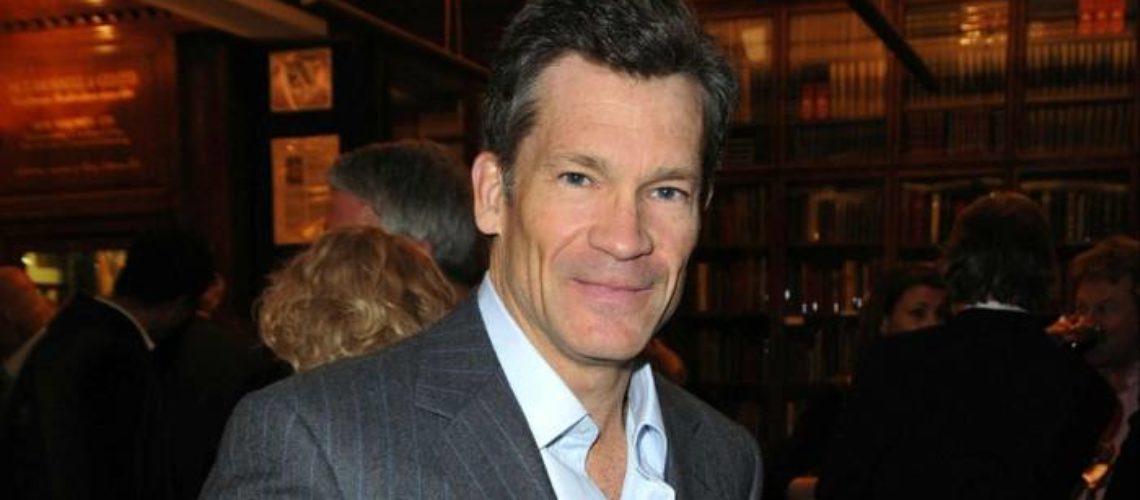

Billionaire investor Louis Bacon’s Moore Capital is enjoying some of its best performance in years, barely six months after announcing it would return money to outside investors and strike out alone.

Mr. Bacon’s New York-based hedge fund firm told investors in November it would shut its flagship funds to external clients and focus on running internal money. It has gained 17 per cent so far this year, according to people familiar with the figures, which would rank it among the world’s best-performing hedge funds.

Gains have come in all areas of the firm — a so-called global macro specialist that trades assets such as bonds and currencies, said one of the people. Among the biggest winning positions this year for such macro traders has been holding government bonds, which have soared as investors have sought havens in the coronavirus-driven market turmoil, while owning gold has also been profitable for some. Such funds tend to have less exposure than many investors to equities, which have been hard hit in the crisis.

The performance has echoes of the huge profits made by Mike Platt’s BlueCrest Capital, the hedge fund firm that announced in late 2015 it would become a family office. At the time Mr Platt said his bets had been constrained by risk-averse institutional investors. Since then BlueCrest has made annual gains of around 50 per cent in three of the past four years.

Returning external money can be a way of lifting returns for hedge fund managers, allowing them to take on more leverage or hold more concentrated positions. Such moves could be blocked by institutional investors such as pension funds and endowments that are often less tolerant of volatility, and that have come to dominate the hedge fund industry since the global financial crisis.

Handing back external money also frees managers from having to meet investors or disclose profits or positions in monthly updates. The lack of reporting requirements tends to make these funds more opaque.

Moore declined to comment.

Moore’s gains, which would rank among its biggest annual returns over the past decade, come as macro hedge funds enjoy a long-awaited revival. Most have struggled for years as central bank stimulus in the wake of the 2008/09 financial crisis dominated market movements and suppressed the volatility that such funds depend on.

However, this year many, including Brevan Howard, Caxton Associates and Dymon Asia, are enjoying double-digit gains. Mr Bacon’s one-time protégé Greg Coffey, who retired from Moore in 2012, is also profiting at his New York-based Kirkoswald hedge fund.

Moore, which was founded in 1989 and is one of the world’s oldest hedge funds, made $19bn in investor profits over the life of its three flagship funds, but had suffered lacklustre performance in recent years.

It told clients in November that “intense competition for trading talent coupled with client pressure on fees has led to a challenging business model for multi-manager funds such as ours”. Returning outside money would let the firm be “more opportunistic in acquiring investment talent” and more competitive with some other big, successful funds.

The firm has now returned almost all of the money it was managing for third parties, leaving two smaller funds that still manage some external capital.

Mr Bacon, a prominent conservationist, also said in November he would be less involved in fund management and would focus more on “personal time for a large family”, “philanthropic pursuits” and developing “a number of sports-oriented properties”.

Read original article here